Love Insurance

What is life (LOVE) insurance ?

1

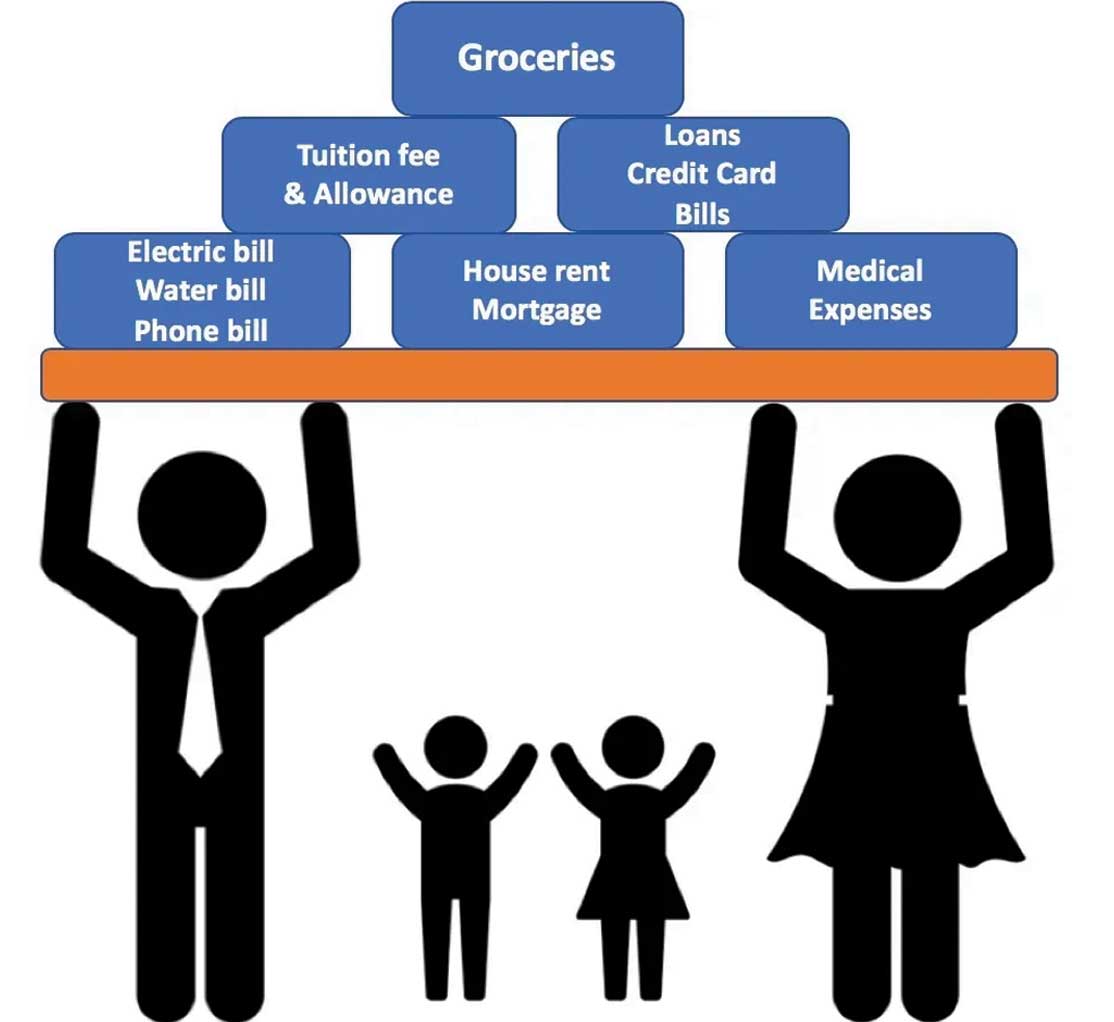

Life insurance protects families and businesses from financial loss associated with the death of a loved one or key employee and as a financial tool for retirement planning.

Life insurance enables individuals and families of all income brackets and lifestyles to maintain financial independence in the face of financial hardships.

Coverage is just as important for two-income families as it is for single-income families. Stay-at-home parents also need protection to help cover the costs of services they routinely provide, such as cooking, cleaning, and caring for children.

Retirees who are living on limited income also find peace of mind knowing that an aging spouse will not be faced with a financial burden after their death.

Life insurance enables individuals and families of all income brackets and lifestyles to maintain financial independence in the face of financial hardships.

Coverage is just as important for two-income families as it is for single-income families. Stay-at-home parents also need protection to help cover the costs of services they routinely provide, such as cooking, cleaning, and caring for children.

Retirees who are living on limited income also find peace of mind knowing that an aging spouse will not be faced with a financial burden after their death.

Benefits of life (LOVE) insurance ?

1

Protects families by providing benefits to survivors when a primary wage earner dies.

The money from a life insurance policy can be used to help families to cover expenses such as mortgage payments, tuition, or sending children to college. Often the benefits from a life insurance policy can keep a family from poverty and welfare.

Businesses use life insurance to protect jobs and families from financial hardships that can result from the death of an owner or key employee.

Businesses use life insurance to protect against financial uncertainty and secure employees’ futures.

The money from a life insurance policy can be used to help families to cover expenses such as mortgage payments, tuition, or sending children to college. Often the benefits from a life insurance policy can keep a family from poverty and welfare.

Businesses use life insurance to protect jobs and families from financial hardships that can result from the death of an owner or key employee.

Businesses use life insurance to protect against financial uncertainty and secure employees’ futures.

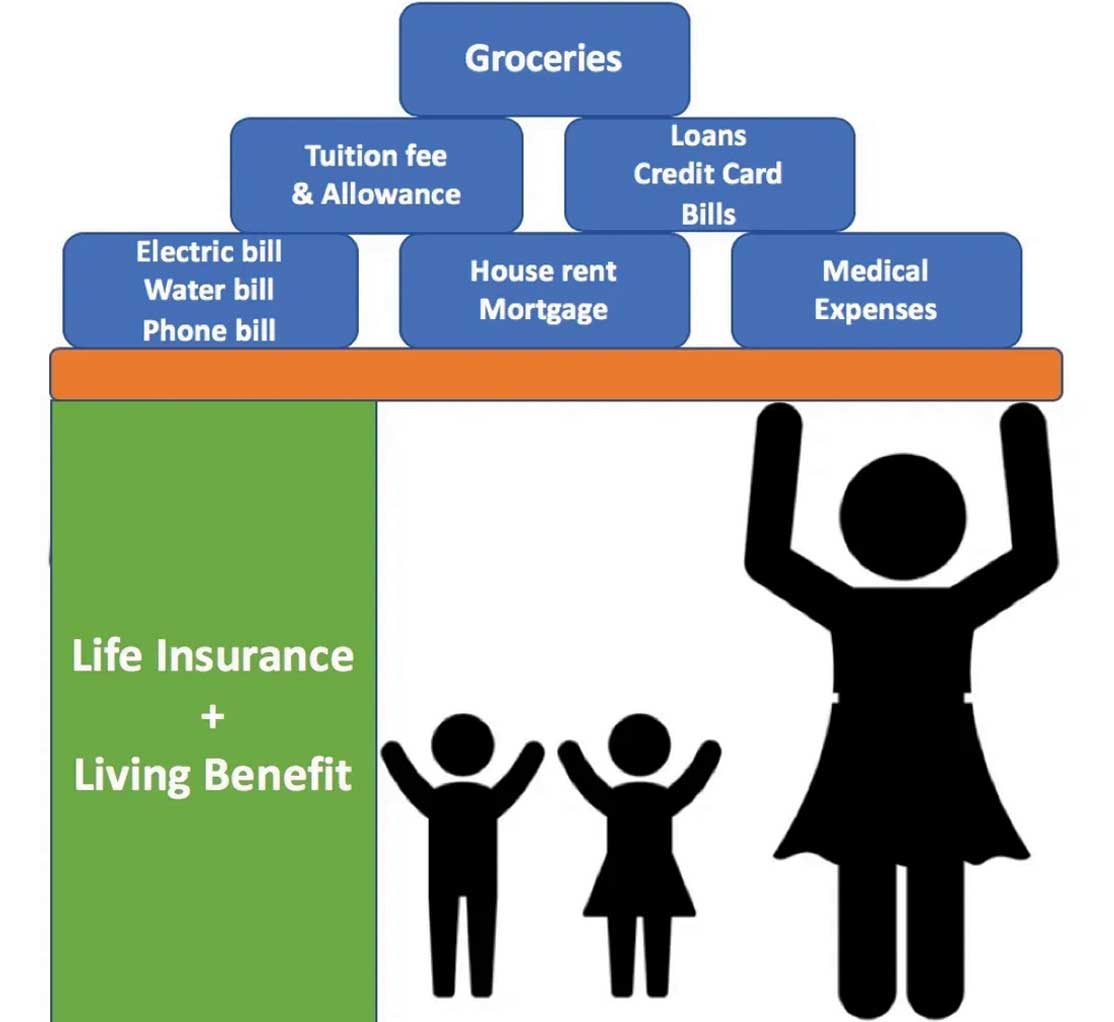

Life insurance you don’t have to die to use

1

You should have access to benefits you can use while you are living.

We feel LSW’s Living Benefits provide a combined solution that you can afford to have, but can not afford to be without.

This unique package can help protect your plans for today and tomorrow.

We call it: Life insurance you don’t have to die to use

What does “life insurance you don’t have to die to use” mean to me?

You can access you policy’s benefits while you are still living. Your benefits may include coverage in case of a:

.Chronic illness

.Critical illness

.Terminal illness

You also have access to your policy’s cash value for events such as education, a down payment on a house, or retirement.

We feel LSW’s Living Benefits provide a combined solution that you can afford to have, but can not afford to be without.

This unique package can help protect your plans for today and tomorrow.

We call it: Life insurance you don’t have to die to use

What does “life insurance you don’t have to die to use” mean to me?

You can access you policy’s benefits while you are still living. Your benefits may include coverage in case of a:

.Chronic illness

.Critical illness

.Terminal illness

You also have access to your policy’s cash value for events such as education, a down payment on a house, or retirement.

Case Study

1

Isaac’s doctor has told him he had less than two years to live. Using the terminal illness rider ( Accelerated Benefit Rider ) he chooses to access his full death benefit to enjoy life to the fullest during his last two years.

1

Nicholas, a husband and father of two, suffers a severe heart attack at the age of 54. He uses his critical illness rider to reduce the policy’s death benefit by $150,000, and in return gets $100,000 in cash today. He is able to use this money to cover his medical expenses, and pay of his family’s mortgage.

1

Juan and Maria are parents of Antonio, a freshmen entering collage. Through policy loans and withdrawals, they able to take $20,000 a year for four years out of their policy’s accumulated value to offset his tuition payments.

CONTACT US

Protect Your Love